News

2019

TORONTO, ONTARIO - November 13, 2019 - Americas Gold and Silver Corporation (TSX: USA) (NYSE American: USAS) (“Americas” or the “Company”), a growing North American precious metals producer, today reported consolidated financial and operational results for the third quarter of 2019 and provides a construction update on the Relief Canyon Mine.

This earnings release should be read in conjunction with the Company’s Management’s Discussion and Analysis, Financial Statements and Notes to Financial Statements for the corresponding period, which have been posted on the Americas Gold and Silver Corporation SEDAR profile at www.sedar.com, on its EDGAR profile at www.sec.gov, and are also available on the Company’s website at www.americas-gold.com. All figures are in U.S. dollars unless otherwise noted.

Third Quarter Highlights

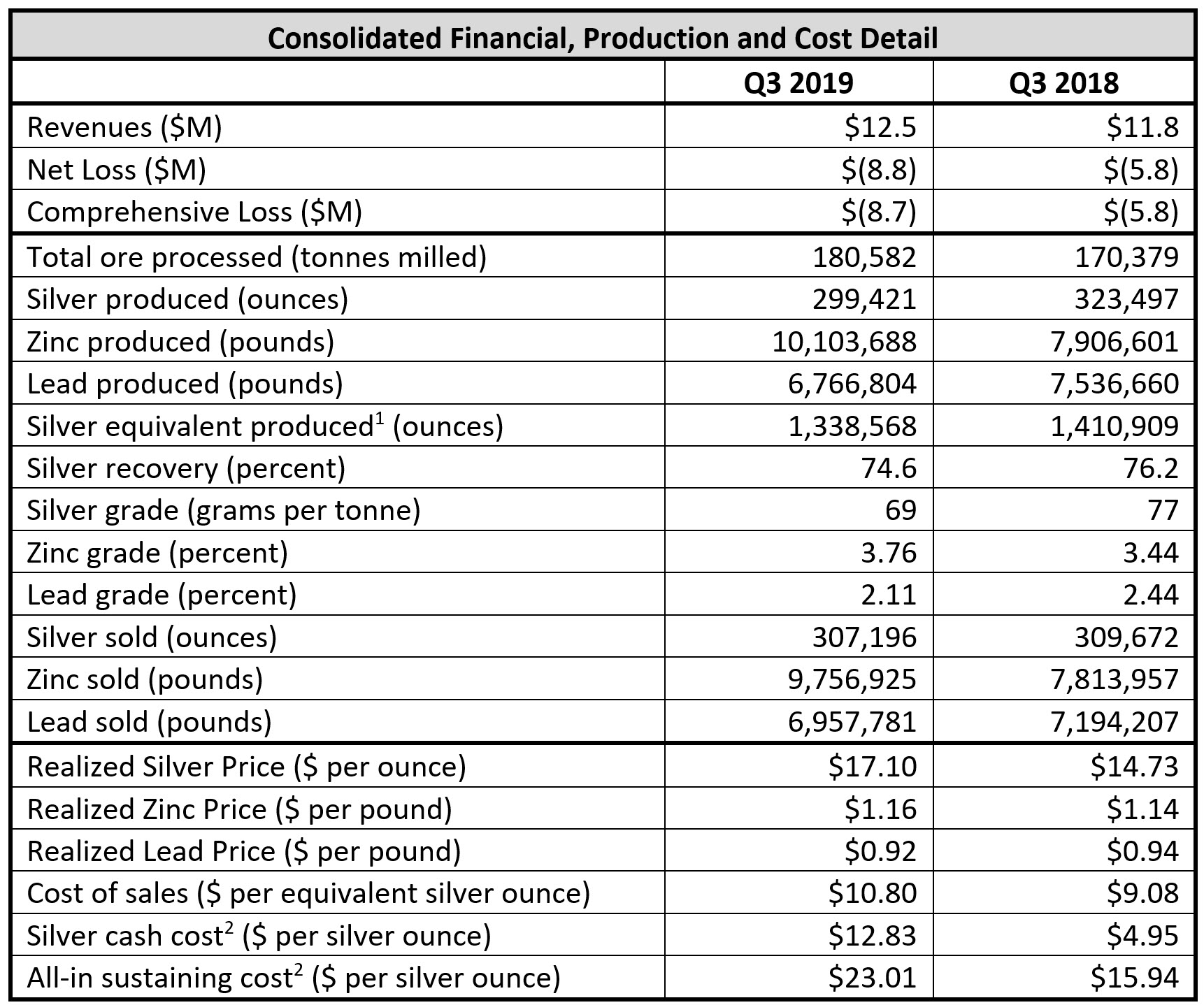

- Revenue of $12.5 million and net loss of $8.8 million for the quarter or ($0.11) per share, an increase of $0.7 million in revenue and an increase in net loss of $3.0 million compared to Q3-2018 due to lower tonnage and grades at the Galena Complex and higher zinc treatment charges at the Cosalá Operations. Higher non-cash one-time items also increased the loss.

- Relief Canyon Mine construction and costs are proceeding as expected with leach pad liner installation complete, the crusher with framework and crushed ore reclaim tunnel installed, the overland and grasshopper conveyors nearing completion, and the ADR plant work proceeding on schedule.

- Americas entered into a joint venture agreement with Mr. Eric Sprott (“Mr. Sprott”) effective October 1, 2019 for a 40% non-controlling interest of the Company’s Galena Complex with initial contribution up to $20 million to fund capital improvements and operations. The goal of the joint venture agreement is to position the Galena Complex to significantly grow resources, increase production, and reduce operating costs at the mine over the next two years (the “Recapitalization Plan”).

- Previously reported third quarter consolidated silver production of approximately 1.3 million silver equivalent ounces[1] and 0.3 million silver ounces, representing decreases of 5% and 7% year-over-year to both silver equivalent ounces and silver ounces, respectively.

- Previously reported third quarter consolidated cash costs[2] of $12.83 per silver ounce and all-in sustaining costs (“AISC”) of $23.01 per silver ounce, both representing an increase year-over-year and from the prior quarter. These increased costs were primarily the result of lower realized by-product prices for lead and expected lower production at the Galena Complex in preparation for the Recapitalization Plan.

- For the three quarters ended 2019, consolidated silver production of approximately 4.8 million silver equivalent ounces and 1.0 million silver ounces at consolidated cash costs of approximately $6.26 per silver ounce and consolidated AISC of approximately $14.11 per silver ounce.

- The Company closed a non-brokered private placement with Mr. Sprott for gross proceeds of $10 million in July 2019.

- The Company had a cash balance of $6.5 million and had drawn $10 million of the available $25 million of the Sandstorm metals delivery agreement as of September 30, 2019.

“As we approach the end of 2019, the Company remains on-track to deliver first gold pour before year end at Relief Canyon, on time and on budget,” said Americas President & CEO Darren Blasutti. “The Cosalá Operations continues to outperform our expectations. A solid Recapitalization Plan with the necessary capital from Eric Sprott provides a clear path forward to increase production with reduced costs at the Galena Complex.”

Relief Canyon Update

On April 3, 2019, the Company’s Board gave approval to commence construction of the mining and heap leaching facilities at Relief Canyon following the Pershing Gold Corporation (“Pershing Gold”) acquisition. The capital cost to develop Relief Canyon to initial gold pour was estimated to be approximately $28 - $30 million with an additional $8 million in working capital required to achieve sustainable positive cash flow. Construction is proceeding well with preparation of the leach pad complete with approximately 3,200,000 square feet of liner installed. Overliner crushing is complete, and placement of the material is advancing well. The primary crusher and the crushed ore reclaim tunnel are installed. The overland conveyor installation is nearing completion with vulcanizing of the conveyor belt expected in the next two weeks. Initial ore placement is targeted for late November with solution application to begin shortly thereafter. The ADR plant is receiving its final upgrades including the installation of new mercury abatement equipment and a revamped electrowinning area. The Company continues to expect to achieve first gold pour from Relief Canyon in late Q4-2019.

Consolidated Results

The Company’s San Rafael mine in Mexico continued to have another successful quarter for Q3-2019 as silver, zinc and lead production increased by 26%, 28%, and 32%, respectively compared to Q3-2018. The strong results at the Cosalá Operations were driven by sustained improvements in head grade of both silver and by-product metals, mill throughput, and metal recovery to concentrate as mining and milling completed the operational ramp-up in 2019 after declaring commercial production in December 2017. San Rafael increased tonnage by 14% and sustained an average milling rate of approximately 1,660 tonnes per operating day during the quarter. Silver grade and recovery rates both increased by approximately 5% and 6%, respectively, with by-product grades and recoveries also increasing. Despite the strong performance at the Cosalá Operations, consolidated silver equivalent production and silver production both decreased by 5% and 7% year-over-year, respectively, due to lower tonnage, and silver and lead grades at the Galena Complex resulting from poor equipment availability and a focus on development over production during the period.

Consolidated gross revenue increased by $4.6 million due to increased production of all metals at the Cosalá Operations coupled with higher silver and zinc realized prices, despite reductions in lead prices between the periods. This increase was partially offset by significant increases in treatment on zinc concentrates ($3.2 million) with average spot treatment charges increasing from approximately $80/tonne to over $235/tonne year-over-year. The increase in revenues was also offset by $0.6 million in decreased silver and lead revenue at the Galena Complex.

On September 9, 2019, the Company entered into a joint venture agreement with Mr. Sprott effective October 1, 2019 for a 40% non-controlling interest in the Company’s Galena Complex. The Recapitalization Plan will allow the Company to advance development, modernize infrastructure, purchase new mining equipment and target exploration potential away from current operating areas. The Company intends to suspend further disclosure of certain operational metrics such as production, cash cost and all-in sustaining cost for the Galena Complex until the Recapitalization Plan is substantially completed, estimated to be by the end of fiscal 2021.

The Company’s profitability was negatively impacted in Q3-2019 by the lower tonnage and grades at the Galena Complex without a decrease in costs, the noted higher zinc treatment charges, higher cost of sales primarily at the Cosalá Operations due to higher tonnage mined and milled, and higher depletion and amortization due to higher production, offset by the previously noted higher gross revenues. Consolidated cash costs increased during the period primarily due to higher industry-wide zinc treatment charges, and lower production and lower silver and lead grades at the Galena Complex.

Further information concerning the consolidated and individual mine operations is included in the Company’s third quarter Condensed Interim Consolidated Financial Statements for the nine months ended September 30, 2019 and Management’s Discussion and Analysis for the nine months ended September 30, 2019.

Q3-2019 Earnings Conference Call

President & CEO Darren Blasutti will be hosting a Q3-2019 earnings conference call on Wednesday, November 13th, 2019 at 4:30pm EST. A copy of the presentation will be made available on the company’s website at www.americas-gold.com.

Step 1: Dial-In

Canada and USA Toll-Free 1-800-917-9985

International Toll Number +1 (416) 641-6705

Step 2: Online Login

https://cc.callinfo.com/r/1ms0vzspva2au&eom

Callers are advised to dial-in 10-15 minutes prior to the call. As there is no audio on the participant URL, please dial-in to follow along with the presentation.

About Americas Gold and Silver Corporation

Americas Gold and Silver Corporation is a high-growth, low-cost, precious metals mining company with multiple assets in North America. The Company expects to begin producing gold in the fourth quarter of 2019 at its fully funded Relief Canyon Project in Nevada, USA, which is currently in construction. It owns and operates the Cosalá Operations in Sinaloa, Mexico and manages the 60%-owned Galena Complex in Idaho, USA. The Company also holds an option on the San Felipe development project in Sonora, Mexico. For further information, please see SEDAR or www.americas-gold.com

Cautionary Statement on Forward-Looking Information:

This news release contains “forward-looking information” within the meaning of applicable securities laws. Forward-looking information includes, but is not limited to, Americas expectations, intentions, plans, assumptions and beliefs with respect to, among other things, the Company’s financing efforts and the expected results from the Recapitalization Plan and the joint venture; future development plans at the Galena Complex; exploration, production and cost performance at the Cosalá Operations and the Galena Complex; construction, production, development plans and performance expectations at the Relief Canyon Mine, including the anticipated timing of production. Often, but not always, forward-looking information can be identified by forward-looking words such as “anticipate”, “believe”, “expect”, “goal”, “plan”, “intend”, “potential’, “estimate”, “may”, “assume” and “will” or similar words suggesting future outcomes, or other expectations, beliefs, plans, objectives, assumptions, intentions, or statements about future events or performance. Forward-looking information is based on the opinions and estimates of Americas as of the date such information is provided and is subject to known and unknown risks, uncertainties, and other factors that may cause the actual results, level of activity, performance, or achievements of Americas to be materially different from those expressed or implied by such forward-looking information. With respect to the business of Americas, these risks and uncertainties include interpretations or reinterpretations of geologic information; unfavorable exploration results; inability to obtain permits required for future exploration, development or production; general economic conditions and conditions affecting the mining industry; the uncertainty of regulatory requirements and approvals; fluctuating mineral and commodity prices; the ability to obtain necessary future financing on acceptable terms or at all; the ability to develop, complete construction and operate the Relief Canyon Mine; the ability of the joint venture to further fund, improve and operate the Galena Complex, and risks associated with the mining industry such as economic factors (including future commodity prices, currency fluctuations and energy prices), ground conditions and other factors limiting mine access, failure of plant, equipment, processes and transportation services to operate as anticipated, environmental risks, government regulation, actual results of current exploration and production activities, possible variations in ore grade or recovery rates, permitting timelines, capital and construction expenditures, reclamation activities, labor relations, social and political developments and other risks of the mining industry. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated, or intended. Readers are cautioned not to place undue reliance on such information. Additional information regarding the factors that may cause actual results to differ materially from this forward‐looking information is available in Americas filings with the Canadian Securities Administrators on SEDAR and with the SEC. Americas does not undertake any obligation to update publicly or otherwise revise any forward-looking information whether as a result of new information, future events or other such factors which affect this information, except as required by law. Americas does not give any assurance (1) that Americas will achieve its expectations, or (2) concerning the result or timing thereof. All subsequent written and oral forward‐looking information concerning Americas are expressly qualified in their entirety by the cautionary statements above.

Cautionary Note to U.S. Investors:

The terms “proven and probable silver reserve”, “silver resource”, “measured silver resource”, “indicated silver resource”, and “inferred silver resource” used in the press release are mining terms used in accordance with Canadian National Instrument 43-101 - Standards of Disclosure for Mineral Projects under the guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum Standards. Mineral resources which are not mineral reserves do not have demonstrated economic viability.

While the terms “mineral resource”, “measured mineral resource”, “indicated mineral resource”, and “inferred mineral resource” are recognized and required by Canadian regulations, they are not defined terms under standards in the United States and normally are not permitted to be used in reports and registration statements filed with the Securities & Exchange Commission (“SEC”). Moreover, the definitions of proven and probable reserves used in NI 43-101 differ from the definitions in the United States Securities and Exchange Commission's Industry Guide 7. As such, information contained in the Company's disclosure concerning descriptions of mineralization, reserves and resources under Canadian standards may not be comparable to similar information made public by U.S companies in SEC filings. With respect to “inferred mineral resource” there is a great amount of uncertainty as to their existence and a great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an “inferred mineral resource” will ever be upgraded to a higher category. Investors are cautioned not to assume that any part or all of the mineral deposits in these categories will ever be converted into reserves.

For more information:

Darren Blasutti

President and CEO

Americas Gold and Silver Corporation

416‐848‐9503

[1] Silver equivalent production throughout this press release was calculated based on silver, zinc, and lead realized prices during each respective period.

[2] Cash cost per ounce and all-in sustaining cost per ounce are non-IFRS performance measures with no standardized definition. For further information and detailed reconciliations, please refer to the Company’s 2018 year-end and quarterly MD&A.